Headline – Performance Against Current Targets

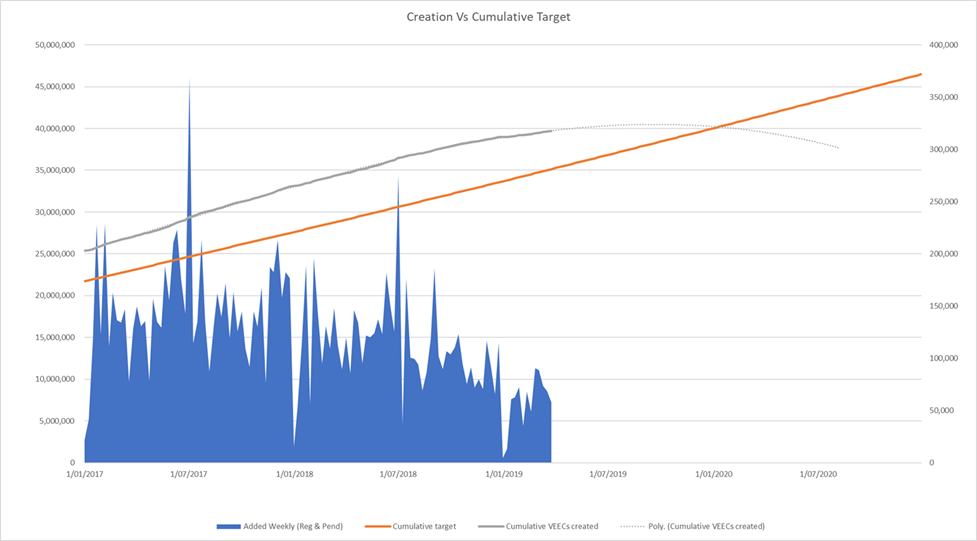

- The 2018 compliance year VEEC surrender is due next month. At this time 6.1M VEECs will be required to be surrendered.

- The current total of 11.3M registered VEECs mean that 5.2M VEECs will remain for surrender against the 2019 target of 6.3M.

- That means that activities generating 1.1M VEECs still need to be undertaken prior to January 2020 to meet the 2019 target.

- The 2020 target is another 6.5M VEECS.

- While meeting the target for 2019 appears academic, meeting the increased 2020 target at current creation rates will not be possible.

- With 92 creation weeks remaining, and a total of 7.4M VEECs required, this equates to an average of 80k VEECs created every single week between now and the end of 2020.

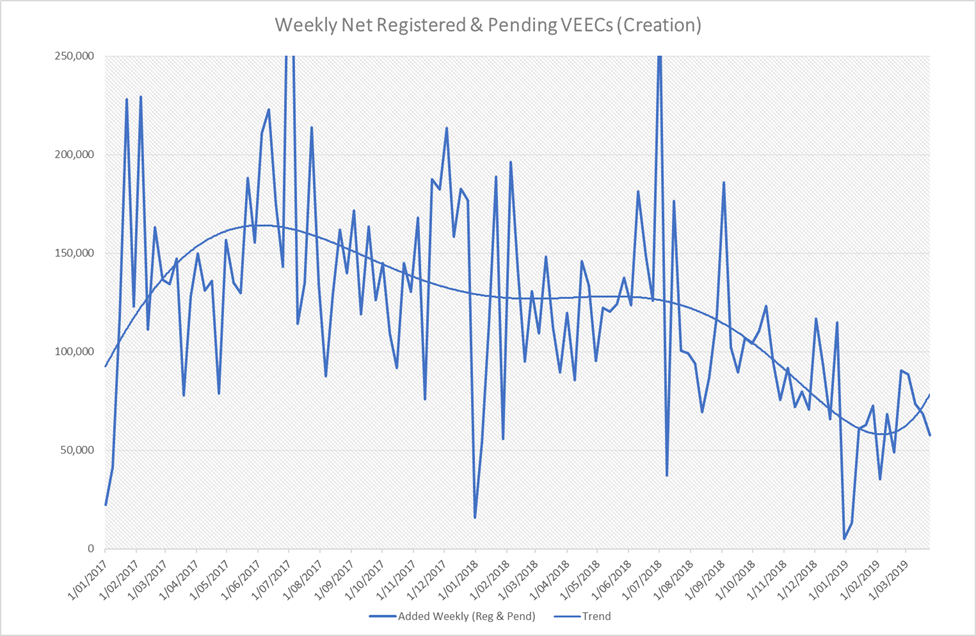

- Creation rates have been trending down since August 2018.

- Current 3-week average is 66k per week. Average for 2019 to date is only 62k.

- This means that forecasts predict that created VEECs will be below required target by the second half of next year.

- Post 2020 targets are being discussed at the moment with further increased targets likely.

The graph below shows creation against targets. The right hand axis is for the cumulative creation and cumulative target, and the left hand axis the weekly creation. Please note, this is creation – not all VEECs created are registered.

Results

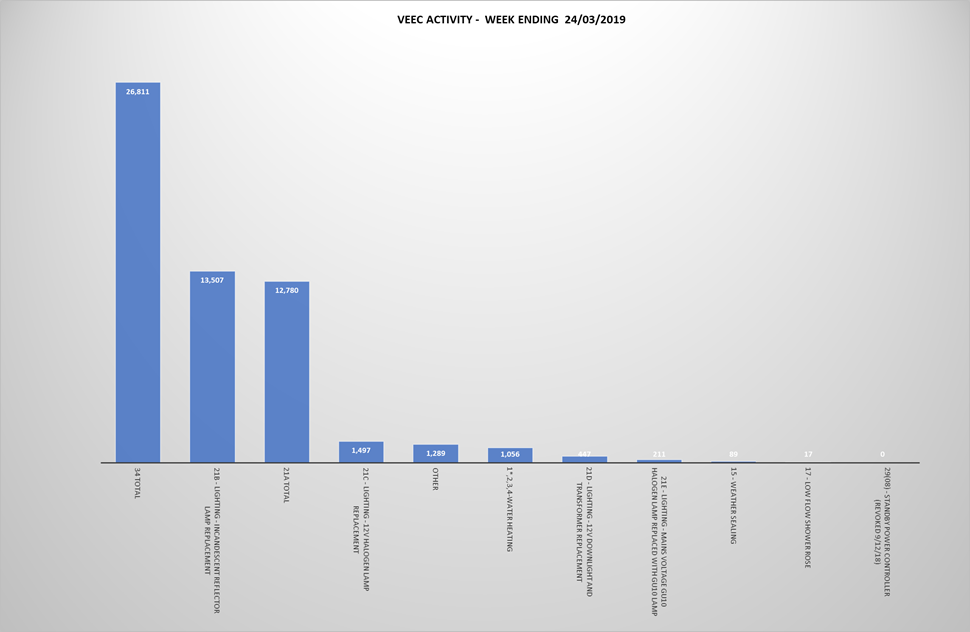

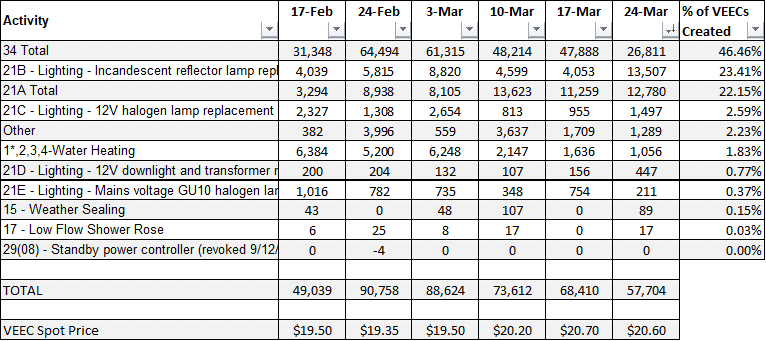

In the week ending 24th March 2019, VEEC creation was as follows:

- 57,704 down 16% compared to the previous week’s creation of 68,410

- The average for the last 3 weeks is 66575

- Commercial Lighting contributed 26,811 (47%) compared to 47,888 (70%) the previous week

- The VEEC spot price was $20.70 COB Friday, down $0.10 from the previous Friday.

- The top 4 creators in CL – Wattly, Cyanergy & Green Energy Trading.

- Updated 21A was slightly up on creation with 12,780 VEECs created compared to 11,259 the week before.

Analysis

The graph below shows the overall trend of total VEECs created each week.